Understanding the IRA Required Minimum Distribution Worksheet: A Guide to IRS Compliance

BlogTable of Contents

- inherited ira distribution table | Brokeasshome.com

- 70 1 2 Ira Distribution Table | Elcho Table

- Ira Required Minimum Distribution Table Ii | Elcho Table

- What are Required Minimum Distributions (RMDs)?

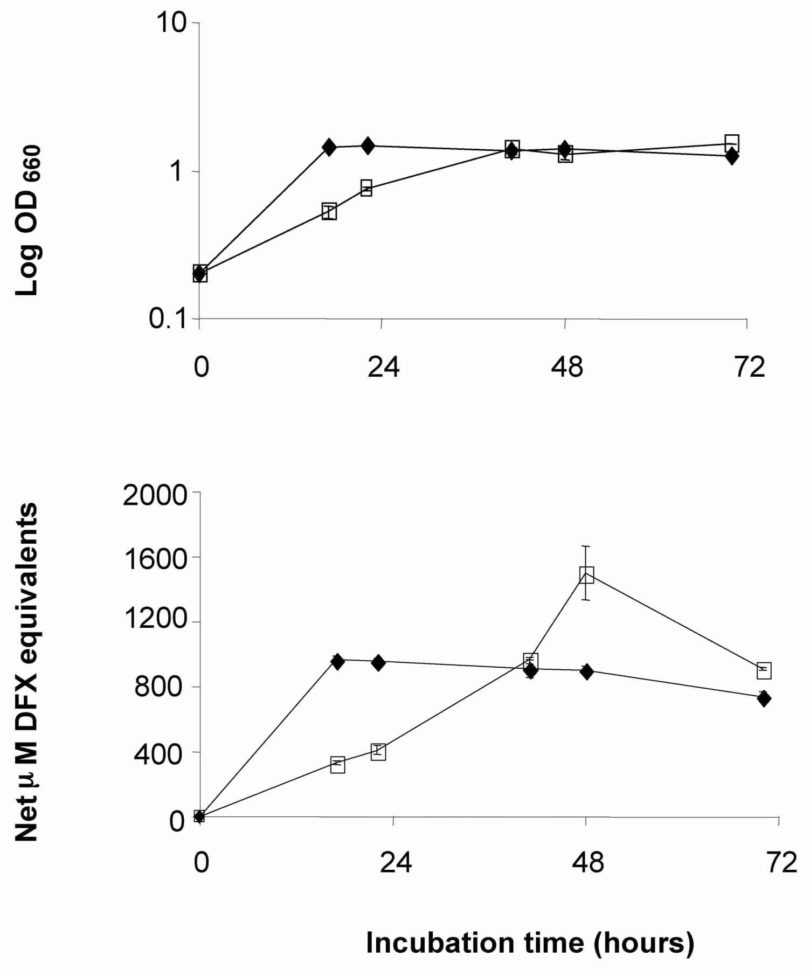

- Figure 1 from Procedure to determine the optimal Roth IRA versus ...

- Beneficiary Ira Mandatory Distribution Table | Elcho Table

- Calculate Ira Minimum Distribution Table | Elcho Table

- inherited ira distribution table | Brokeasshome.com

- Ira Minimum Distribution Table For Beneficiaries | Elcho Table

- 22 Inspirational Stock Of Ira Mandatory Distribution Chart — db-excel.com

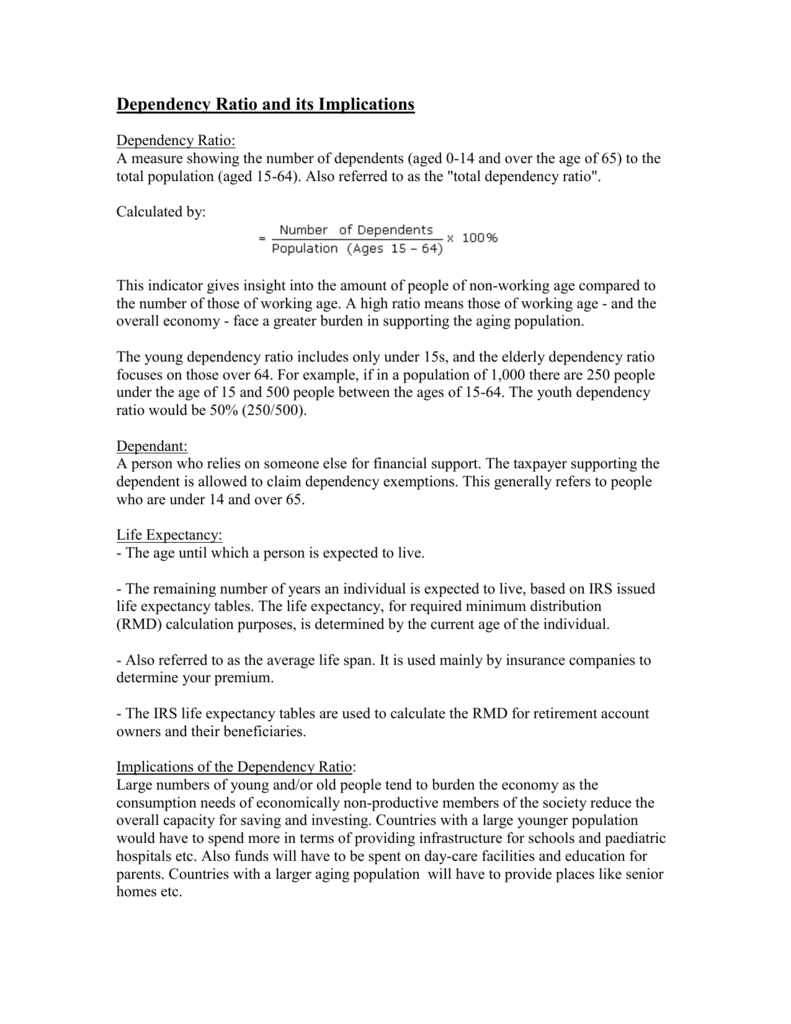

What are Required Minimum Distributions (RMDs)?

/dotdash_Final_The_Normal_Distribution_Table_Explained_Jan_2020-01-091f853d86c444f3bd7cd32c68fc0329.jpg)

The IRA Required Minimum Distribution Worksheet

How to Use the IRA Required Minimum Distribution Worksheet

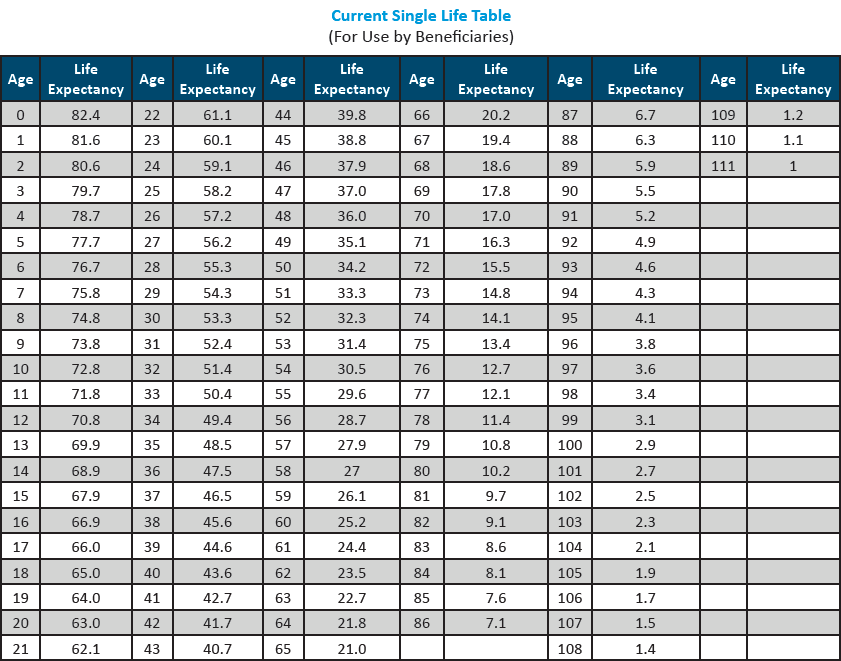

Using the worksheet is relatively straightforward. Here's a step-by-step guide: 1. Gather your account statements and determine your account balance as of December 31st of the previous year. 2. Use the Uniform Lifetime Table to find your life expectancy factor based on your age. 3. Divide your account balance by your life expectancy factor to calculate your RMD. 4. Review your calculation to ensure you're taking the correct amount.

Penalties for Not Taking RMDs

It's essential to take your RMDs on time to avoid penalties. If you fail to take your RMD, you may be subject to a 50% penalty on the amount you should have withdrawn. For example, if your RMD is $10,000 and you don't take it, you may be liable for a $5,000 penalty. Understanding the IRA required minimum distribution worksheet is crucial for ensuring compliance with IRS regulations. By using the worksheet and following the calculation steps, you can determine your RMD and avoid potential penalties. Remember to review your account balance, life expectancy factor, and RMD calculation annually to ensure you're meeting your obligations. If you're unsure about any aspect of the process, consider consulting with a financial advisor or tax professional. By taking control of your IRA RMDs, you can enjoy a more secure and predictable retirement, knowing that you're making the most of your hard-earned savings. Take the time to explore the IRS resources and worksheets available to you, and start planning for a brighter financial future today.Keyword: IRA required minimum distribution worksheet, Internal Revenue Service, RMD, retirement planning, IRS compliance